Brand Selection Summary

First Place to Shop…First Place to Save

Fallas motto

Today when tabloid magazine readers get excited over photos of Channing Tatum and Beyonce shopping at Target in US Weekly, it feels like bargain hunting still isn’t acceptable. For the cool and sophisticated, however, “cheap chic” has always been around and the rest of us are playing catch up. Around 2000, when the economy took a dive “down shopping” was the preferred way hanging onto your disposable income. A “reverse snob appeal” punctuated conversations and any time someone complimented you on an elegant dress or skirt you’d bought at your local Ross Dress for Less, you thanked them with a haughty tone and felt ultra-smart.

Now, over 10 years later, dressing and decorating “high-low” has become such a popular occupation lifestyle specialists, Martha Stewart, Rachel Ashwell and Joanna Gaines have developed niche industries merging the precious with the pricey. The possibilities are endless, for the average person, who can now be au courant regardless of their piggy bank.

Within this retail genre of discount shopping a mind-boggling series of sub-genres exist-big box, extreme, membership-only warehouse clubs, multi-price point variety chains, and off-price- that’re all competing for the same dollars.

Fallas, whose store motto is First place to shop…First place to save, has established itself among its regulars as a go-to place for school uniforms, scrubs, and on-trend apparel. Maite Perroni even had a co-branding collaboration with them, in 2014, for the line Collection Maite Perroni.

Fallas Store Interior

Sneakers at Fallas Stores

Fallas Files Bankruptcy

Unfortunately, in August 2018, National Stores Inc. (Fallas’ parent company) was forced to file Chapter 11 bankruptcy and close 74 of its 344 stores. Later that year, they were saved financially and purchased by Seventh Avenue Capitol Partners LLC. Renamed Fallas Stores and allowed to remain in their headquarters in Harbor Gateway, California. At this point they need to reinvent themselves.

Their online presence needs to be strengthened and professionally developed. Customer service protocol needs to be instituted for their store staff. The quality and style of their clothing has become inferior, so that needs to be addressed to

How to Fix What’s Wrong with Fallas Stores

My suggestions for making over this store would start with a complete brand focus and look. A more cohesive and curated design with professional interior and exterior layouts is needed, along with a change in their product mix. I would also like to see a more inclusive atmosphere, open to all the target ethnic shoppers that visit their stores. An updated and refined logo would help, as well, and could bring in new customers. A switch to garments made from both sustainable and natural fibers, instead of synthetics, would give their appeal an aesthetic and environmental appeal that would prevent a public backlash against environmental pollution. Poised at the precipice of this second chance, if Fallas Stores makes these changes they might be able to avoid their previous mistakes and thrive again in their retail environment.

Sock Display at Fallas Stores

Sock Display at Fallas Stores

Sock Display at Fallas Stores

Sock Display at Fallas Stores

Back Story: Fallas Stores

In a small “single-store operation” in 1962 Joseph Fallas founded a new family-owned business, Fallas Parades, in Downtown Los Angeles. Based in Gardena, California, it was initially marketed for the Latino consumer. Operating under its business umbrella, National Stores Inc., it “primarily served low-income communities by selling men’s, women’s, children’s apparel and household items for under $20.” Joseph’s son, Robert is their CEO.

Throughout its existence, the company has expanded by acquiring other companies, usually thought “bankruptcy auctions.” In 2001, they acquired 31 of Weiner’s stores; in 2004, 100 Factory 2-U stores; in 2014, 78 Conway stores, and in 2015, 40 Anna’s Linens. By 2016 Fallas had 344 locations, in the U.S. and Puerto Rico, (where it’s known as Falas). They had $l202,500,000 in sales and around 1,001 employees. Among “companies with similar revenue,” that year, were Zara Belgique S.A./N.V. at $209,600,000 and Gucci at $195,400,000. Profits didn’t get in the way of their dedication to the community, and in 2018, store manager Don Greene was awarded an Operation School Bell Award by the Assistance League of Victor Valley for his support for those in need.

That same year, trouble hit them, and a Chapter 11 bankruptcy became part of their tale. Bad luck caused by “low-performing stores,” Hurricane Maria in Puerto Rico and a malware security breach, were the looming problems. Currently they’re also over $1 million in debt and owe clothing manufacturer Armouth International $15.6 million, One Step Up $10.3 million, Louise Paris around $4 million and Seven Apparel $3.9 million. Understandably, during this part of their history, it’s natural to want to retain their business relationships with proven manufacturers. The problem is, compared to the upscale clothing and accessories lines offered by Ross Dress For Less, Target, Walmart and their other competitors Fallas’ offerings seem overly trendy and paste.

Discounted fashion, in 2019, is in a transitional place without too much brand loyalty, causing the well-dressed consumer to shop wherever the best deal is. The trick now is to create an image where Fallas Stores are a reliable resource for wardrobe additions.

Current Brand Status:

After filing in the U.S. Bankruptcy Court for the District of Delaware on August 2018, National Stores Inc. went from Chapter 11 to Chapter 7. With this process, and the partnership with Second Avenue Capital Partners LLC, Michael Fallas feels it enabled him to “preserve 2.500 jobs, keep 85 stores open, and continue providing their customers with an enjoyable shopping experience.”

On March 1, 2019 two new Fallas Stores re-opened one at Plaza La Cienega Shopping Center, in Los Angeles, California, and one in El Paso, Texas. Previously closed on September 11 by the fire department, due to an electrical fire they could re-open once the “safety problems were resolved.”

For years, Fallas has catered to a predominantly Latino demographic which was the focus of Fallas Paredes. Now they’ve chosen to re-open in the larger building that used to house the Toys ‘R’ Us and Babies ‘R’ Us stores at 1833 S. LaCienega Blvd., and have a noticeable presence online. African-Americans and other races have started shopping there changing how the brand is critiqued and accepted.

What was once considered “fashionable” among their regular demographic has been deemed unacceptable and dated by these new demographics. Even among their competitors Target and Walmart they appear to fall behind, because they still offer too many items that “look as if they come from a discount store.”

Facebook Announcements About Fallas

Their social media presence includes Instagram (fallas_discount_stores) where they have about 25 posts and 125 followers, Facebook, Twitter (@fallasstores) with 77 followers, and Pinterest with 521 followers and 32 monthly views. Although they don’t promote it widely, if a consumer wants to subscribe to their emails and learn about “new store openings, promotions and new merchandise” they can log onto https://www.fallasstores.net. If they want to know what’s happening in the men’s or women’s section they can log onto either https://www.fallasstores.net/women or https://www.fallasstores.net/ment. They’re also available on https://www.allweeklyads.com.

Online Fallas Stores Shopper

SITUATION ANALYSIS PART 1: MARKETPLACE

Historically, Fallas have tried to offer their customers inexpensive styles, in clothing, accessories and housewares that are more budget-conscious than stylish. I would say now their womenswear is heavily Latina in that it currently emphasizes the boho chic of Frida Kahlo, the rugged gear of the chola and the sleek sexiness of performers Selena Gomez and J.Lo. The menswear, while classic, is sportier and more utilitarian. The casual L.A. lifestyle adds to the ease of their selection, along with prevailing trends, distinguishing them in a place that’s safe but conformist and modern. Their niche places them in direct competition with other companies who’re providing better products at the same low prices, such as Walmart, Target, and Ross Dress For Less. For this project I will examine what makes them similar and what distinguishes them from each other.

WALMART

Like Fallas, this company was also founded in 1962. Founder Sam Walton, unwilling to directly compete with Sears and Kmart, opened in Rogers, Arkansas and concentrated on the rural market instead. It has since become one the top discount stores in the world. With a similar clothing philosophy to Fallas, today they offer inexpensive styles for the whole family. This year they premiered their new We Dress America campaign and have continued to advocate for sustainability. By embracing and promoting this important issue Walmart has surpassed Fallas by displaying increased responsibility for their “global footprint.”

TARGET

Target originally a “mass-market retail company” started by George Draper Dayton in 1902 in Minneapolis, Minnesota, and known as Dayton Dry Goods Company finally became the first “Target on May 1, 1962.” Like Walmart, they began offering covetable fashion gear, and have consistently added new lines regularly

Neat and well-organized, their separate departments for Wild Fable, Universal Threads, A New Day, Who What Wear, Knox Rose and others, resembles Fallas’ spacious new in-store layout. Unfortunately, Target suffered a “major data breach in 2013,” and like Fallas, it cost them financially too. With the improvement of their merchandise selection, interiors and customer service they’ve been able to win back regulars.

ROSS DRESS FOR LESS

Ross Dress For Less was launched by Morris “Morrie” Ross in 1950 in San Bruno. Where Walmart and Target are discount stores, Ross is an off-price store that regularly sells “department store brands at reduced prices.” Like Fallas, they’re also known for their designer and high-end labels. Their future, for 2019, include expansion of over 100 stores. Earlier in March 2019, “their posted fourth-quarter earnings results were $441.7 counts million on revenues of $4.11 billion.”

Upon analysis it’s easy to see why a consumer would shop at each store and have three different experiences, despite their range of merchandise. While Fallas, still struggles through their business travails Walmart, Target and Ross Dress For Less remain relevant with a wider demographic by providing excellent inventory, appearing on T.V. in high profile commercials, and being as strong online as on-site. Compared to the way Fallas presents itself the disparity is glaring and demonstrates why they need to refine their discount store image.

Now they find themselves in a strong place with those who’ve always looked to them for inexpensive goods, but in a weak place with those who’re new to discount shopping and expect better quality despite the price tag. At this point, the areas of discrepancy are the ones that should be addressed first.

SITUATIONAL ANALYSIS PART II: CONSUMERS

Since 2012, consumers have accepted a new way of shopping that doesn’t look down its nose at bargains. Fallas shoppers, and the newly initiated, who habitually troll the aisles at Target, Walmart and Ross Dress For Less and other lower-priced retailers are pleased with the benefits. For Fallas, who’s had a predominately Hispanic demographic shopping there, they face certain dynamics particular to this ethnicity. The following facts feature the particulars. : (Targeting the Ethnic Shopper by Jennifer Popovec).

- Hispanics shop as a “multigenerational” (the whole family on one shopping trip).

- First generational shoppers want merchandise that reminds them of home.

- Non-English speaking Hispanic shoppers prefer bilingual signs and Spanish speaking clerks and managers.

Although statistics show that by 2020 “Hispanics will be the largest minority with 57 million,” now that Fallas has gone through bankruptcy and re-opened in areas with more diverse demographics they need to be more inclusive. That includes considering the needs of African-American, Asian, and Caucasian customers by race and “lifecycles.” “Generation X” (38-52 year olds) and “Baby Boomers” (53+ year olds) want “deals”, “convenienc” and “variety”. They prefer “personalized email and direct mail” correspondence with less attention paid to overall social media.

Various ways Fallas can attract this customer on-site is with “artisan goods” that’s from Africa, Asia and other countries, and with items featured during holidays and occasions other cultures celebrate (i.e., Black History Month, and Year of the Pig). Regular tie-ins with the city’s cultural events that reflect these cultures would be a good idea too (i.e., Alvin Ailey Dance Theater, the Charles White exhibit that was at LACMA and Shen Yun Performing Arts). Online they can strengthen their accounts on Facebook, Instagram, Twitter and Pinterest with more professional photos and an interactive hashtag blog that allows customers to post selfies of themselves in their Fallas finds.

RECOMMENDATIONS FOR REINVENTION

When the new Fallas opened on March 1, 2019 at Plaza La Cienega Shopping Center the exterior and interior of the store looked great, but after looking around and considering that they didn’t advertise their re-opening, it’s apparent they still have a ways to go before successfully entering the new retail game.

PRODUCT

Starting with the logo, it needs to be modernized enough to make recyclable shopping bags, store t-shirts, business cards, brochures, flyers and other on-site advertisements stand out.

Next their product line needs to be upgraded to include fewer trendy pieces, that’s made from synthetics, to ones that’re made from sustainable and natural fibers. Besides being aesthetically pleasing natural fabrics are “breathable,” “softer,” and “biodegradable” where synthetics can be toxic and harmful to one’s health and the environment.

Instead of the manufacturer that created the 100% polyester sleeveless A-line dresses, I saw when I visited, they should try clothing made by a local manufacturer instead. Annie Bananie Apparel, a custom-made line manufactured in Los Angeles would be a great choice for this department.

Their accessories are fine, but they should try to tie them in with the merchandise better by creating face-out and small shelf displays within or near the other sections. The walls within should be utilized better too and instead of a plain array of merchandise a story should be told with the colors, silhouettes and arrangement of the garments and accessories.

Besides changing the merchandise, Fallas needs to replace their current hangers with classier ones that would make the merchandise look better. A few mannequins, arranged in a boutique style, would create a nice, intimate feel. A similar technique would work throughout the rest of their store.

PRICE

Since Fallas is a discount store their pricing is “set to encourage sales at the consumer level,” making part of their draw the prices. The two types of strategies they use are “pricing below competition” and “economy pricing” which seems to work for them. Traditionally factors that affect the prices at Fallas, and allow them keep them so low, are a “dependence on imports” and hiring minimum wage workers. Two external factors that affect them adversely, as well as the rest of retail, are “organized retail crime” and budgetary restraints on consumers.

PLACE

Fallas seems to have always depended on brick and mortar placement, with a minimum of online presence, I would strongly recommend developing a stronger online presence that should include a mobile app, online shopping opportunities, and daily posts on Instagram.com where merchandise can be tagged and bought. Their competitors all have mobile apps, and T.J. Maxx, even has a personal shopper feature one theirs called “create your shop.” An app, and other online experiences, would also help them gain increased loyalty from old and new customers in the future.

PROMOTIONS

Locally, Fallas should be promoted in the Los Angeles Times, Los Angeles Sentinel, Our Times, The Argonaut and other metropolis newspapers that serve their demographics. Press releases can be written by a staff writer when they have something to promote that’s newsworthy. Their grand re-opening would’ve been perfect.

Inexpensive ads can be placed in the Value Pak, along with sale coupons and flyers that accompany supermarket circulars. Magazine ads in US Weekly, InStyle, Vogue and Harper’s Bazaar might be more expensive but would catch the eye of Fallas’ consumers who want to keep up with Zoe Saldana, Selena Gomez, Zendaya, Tracee Ellis Ross, Gina Rodriguez or Jennifer Lopez, making them excellent places to advertise.

PEOPLE

Before Fallas filed for bankruptcy, they had numerous complaints that were posted online to yelp.com and pissedconsumer.com/complaints. To turn around this negativity they need to “educate their staff” by having weekly store meetings to teach them how to create a positive environment where customers feel welcome.

NEW TACTICS

Additional steps Fallas should take to insure financial success, maintain customer loyalty, attract new markets and compete effectively would be as elemental as (1) creating a weekly blog on their website; (2) replacing their current shopping bags with chic recyclable ones; (3) printing survey feedback information on their receipts; (4) creating in-store clothing catalogs and flyers that can be given away and mailed to customers; (5) collaborating with nearby stores for seasonal fashion shows within the store; and (6) doing more Hollywood collaborations with style icons Penelope Cruz, Zoe Saldana, Selma Hayek, Selena Gomez, Bianca Jagger, Benecio del Toro, Javier Bardiem, Jennifer Lopez, Zendaya, Daisy Fuentes, Antonio Banderas, Tracee Ellis Ross and Samuel Jackson.

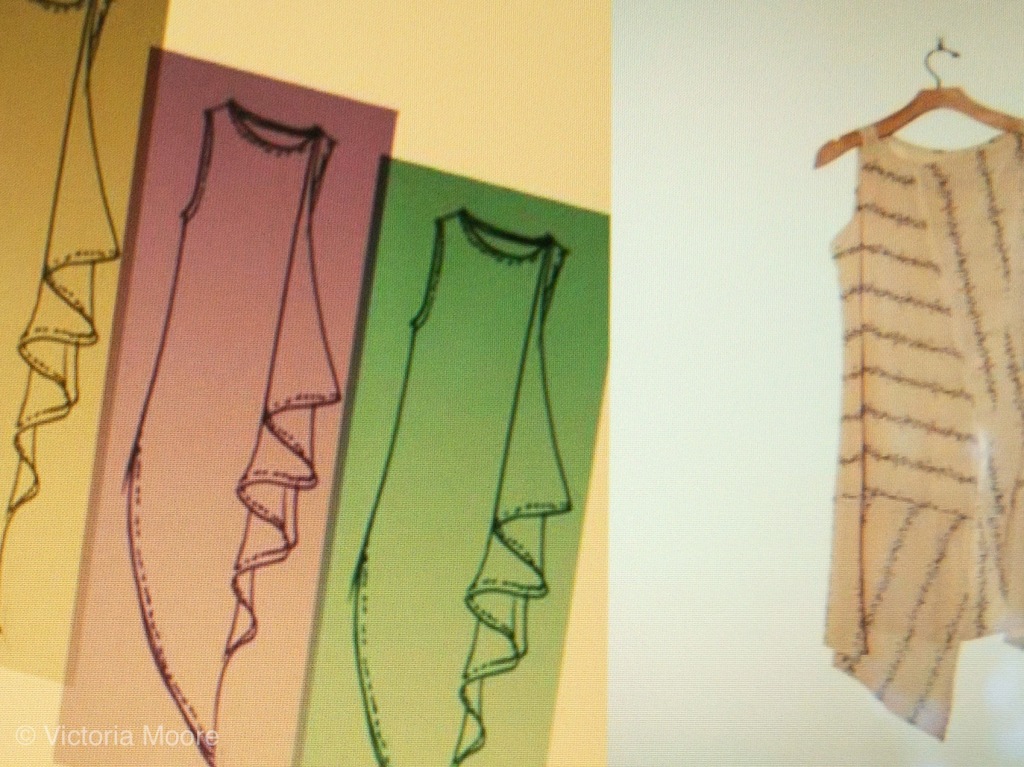

FALLAS IDEA BOARD: CLOTHING AND ACCESSORIES

WORKS CITED

Crouch, Dorothy. “Discount Retail Favored by U.S. Consumers Regardless of Age or Income.” California Apparel News, October 12-18, 2018.<apparelnews.net>

Peltz, James F. “Parent of Fallas retail chain files for bankruptcy, will close dozens of stores.” Los Angeles Times, August 06, 2018. <https://www.latimes.com/business/la-fi-fallas:bankruptcy-20180806-story.html>

Narayan, Shwanika. “Fallas Plans to Get Back Up: RETAIL: Everything but e-commerce hit discount chain.” Los Angeles Business Journal, August 20, 2018. <https://www.bigalegroup.com.ezproxy.lapl.org/essentials/articleGALE %7CA559906>

Gonzalez, Jessica. “Fallas manager receives Operation School Bell award for helping low-income families.” Daily Press, May 5, 2018. <https://wwww.dailypress.com/news/20180515/fallas-manager-re…ool-bell-award-for-helping-low-income-families?template=ampart>

Friedman, Arthur. “Walmart Commits to New Plastic Packaging Waste Reduction.” Sourcing Journal, February 26, 2019. <https://o-sourcingjournal-com. library.academyart.edu/topics/sustainability/walmart-plastic-packaging-waste-reduction-141032/>

Kolenc, Vic. “Fire hazards resolved in historic Downtown El Paso building: Fallas Discount Store reopens.” El Paso Times, March 4, 2019. <https://www.elpasotimes.com/story/money/business/2019/03/02/f…town-el-paso-building-deemed-fire-hazard-in-2018/3034209002>

Belgium, Deborah. “Parent Company of Fallas Paredes and Factory 2-U Files for Bankruptcy Protection.” California Apparel News, August 7, 2018. <https://www.apparelnews.net/news/20108/aug/07/parent-company-fallas-paredes-and-factory-2-u-file/>

Dun and Bradsteet. “Discount Department Stores.” Dun and Bradstreet, December 17, 2018. <www.firstsresearch.com>

Young, Vicki M. “Ross Stores to Open 100 New Locations in 2019.” Sourcing Journal, March 11, 2019. <https://o-sourcingjournal-com.library.academyart.edu/topics/retail/ross-stores-inc-open-100-new-locations-2019-dress-for-less-dds-discounts-147249/>

Popovec, Jennifer. “Targeting the Ethnic Shopper.” Natl Real Estate Investor 48 no5 My 2006. <www.nrimag.com>

Lesonsky, Rieva. “Demographics Secrets Revealed: The Ultimate Guide for Retail Marketing to 4 Generations of Shoppers.” Small Business Trends, July 25, 2017. <https://www.smallbiztrends.com/2017/generational-marketing.html>